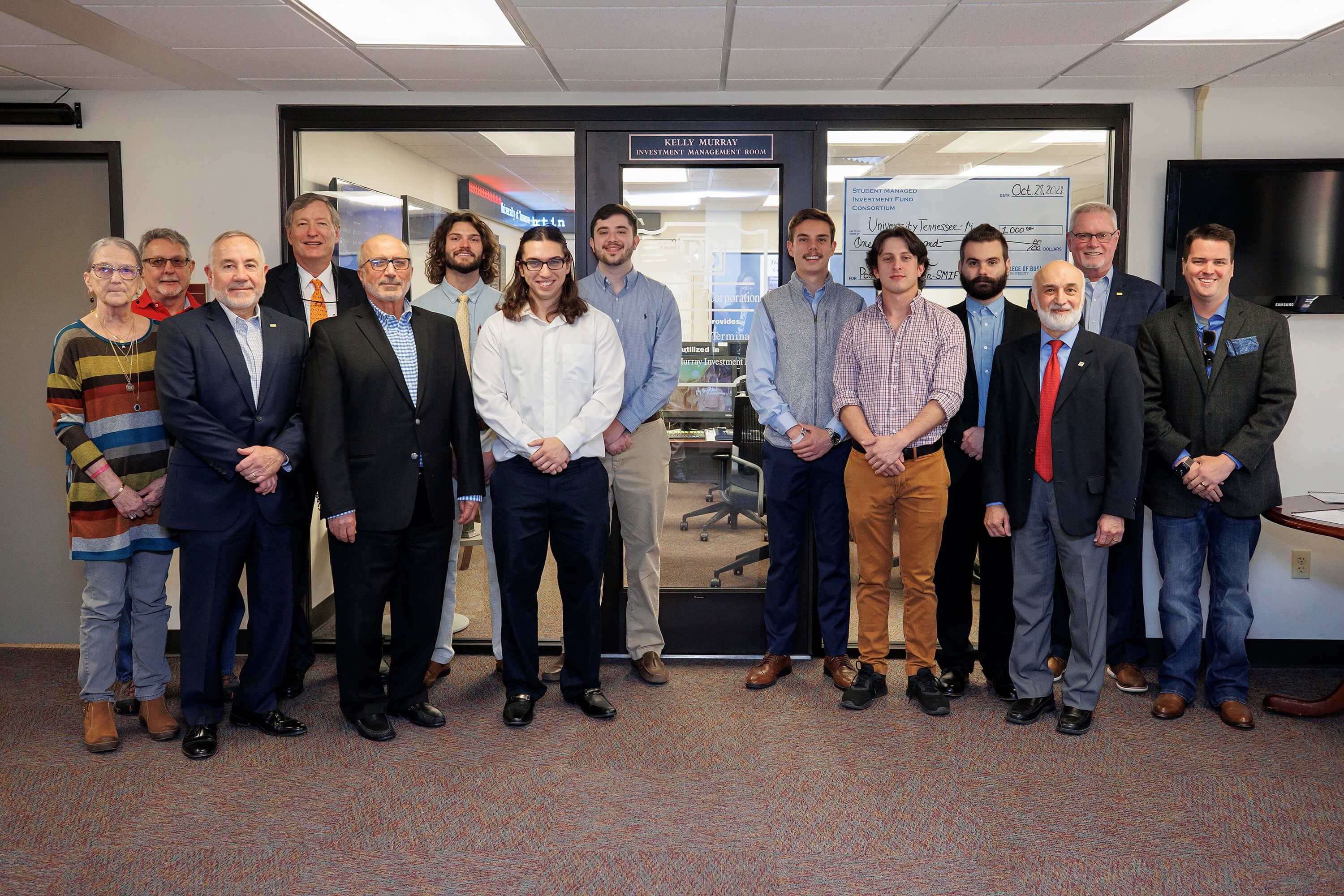

Members of the University of Tennessee at Martin-TVA Investment Challenge team finished first among 27 universities competing in the Student Managed Investment Fund Consortium held Oct. 28-29, 2021, in Chicago. Student portfolio managers enrolled in Finance 411, a class taught by finance professor Dr. Mahmoud Haddad, were recognized for their accomplishments Dec. 3 by the UT Martin College of Business and Global Affairs. The team received $1,000 for finishing the conference in first place.

The UT Martin team earned a 24.61% return on the team’s portfolio during the fall semester for an annualized return of 28.23%. The UTM-TVA portfolio grew from $618,563.32 on Jan. 1, 2021, to $768,226.50 on Nov. 19, just short of its goal to outperform the S&P 500 index by 250 basis points or 2.5%. Team members presented their TVA portfolio strategy at the SMIFC conference, which earned top honors.

TVA’s Investment Challenge was established in 1998 and is a partnership between TVA and participating universities in its service territory. The challenge provides a real-world learning experience in portfolio management by allowing students to manage actual stock portfolios within TVA guidelines. In addition to TVA, other investment-team supporters include the family of Kelly Murray and FirstBank. Haddad said that preparation both in general courses and in the College of Business and Global Affairs was the key to the team’s success.

“The basic and core courses that we teach in the College of Business and at the university in general are a strong foundation to make our students in the top of their career and the top of their performance among 27 different universities,” he said.

“The basic and core courses that we teach in the College of Business and at the university in general are a strong foundation to make our students in the top of their career and the top of their performance among 27 different universities,” he said. Haddad added that this year for the first time the brokers and dealers who support the challenge allowed a portion of the investment returns to be used to offset related expenses for the participating students.

Logan Alfano-Webb, a senior double major in finance and economics from Counce, Tennessee, received the Kelly W. Murray Excellence in Portfolio Management award for the fall semester and his work with the team. The award, named for the late son of Dr. Sandra and Bill Murray, recognizes outstanding effort and dedication managing the UT Martin TVA stock portfolio with the TVA Investment Challenge. Sandra Murray is a retired UT Martin education faculty member.

The Kelly Murray Investment Management Room located in the Business Administration Building is named for Murray in recognition of his leadership of the investment team when he was a student. Among the room’s features are Bloomberg Terminals, a professional trading platform. FirstBank endowed the UTM-TVA program with 12 Bloomberg Terminals that students use to obtain financial data and become Bloomberg certified. Bloomberg Certification is an advantage for graduates seeking positions in the competitive finance field.

The TVA Investment Challenge’s performance report noted that the team’s all-equity portfolio focused on stocks in the communication, technology and material sectors and included both value and growth stocks. Portfolio managers used fundamental and technical analysis to monitor positions in the portfolio and analyze stocks to consider trading. The individual portfolio managers were responsible for staying current on economic events, news and using available resources to collect information that would positively influence portfolio performance.

Sector managers for the team, all senior finance majors at the time of the competition, were Alfano-Webb, technology and materials; Seth Bishop, of Adamsville, communication and utility; Alexzander Schell, of Madisonville, Kentucky, financials and real estate; Heath Hester, of Martin, consumer staples and health care; Brice Williams, of Dresden, energy and industrials; and Kyle Hart, of Union City, consumer discretionary.

“He (Haddad) may be one of the most intelligent people I’ve ever met and especially when it comes to financial markets,” he said.

Alfano-Webb noted several factors that contributed to the team’s success starting with finance professor Mahmoud Haddad who advised the team when asked for guidance and executed the stock trades based on team members’ buy-and-sell decisions. “He (Haddad) may be one of the most intelligent people I’ve ever met and especially when it comes to financial markets,” he said. “I can’t say enough. We went to the conference in Chicago, and everybody knew him there. I think that says a lot about his character and what he’s accomplished throughout his life.” He also credited the quality of his team’s conference presentation and the university’s TVA Investment Challenge history for laying the groundwork for success.

“We presented in front of industry professionals and people with doctorates and other professors from other universities, and they were all very impressed with us,” he said. “This is long-lasting program at UTM – over two decades – so we had the blueprint for success. We decided to execute, and I believe we did it, and we did it well.”

###